Digital Health: more ideas, less money for startups

Global investors look for safer bets today, leaving less money on the table for other companies. But the market demand for innovation is still strong.

Is digital health still a thing? The question might seem stupid - of course the digitalization in Health sector is a key technological evolution - but it makes sense when considered from startups' point of view. Many neocompanies targeted the Health market with new solutions and services, but now there are less and less funding opportunities for them.

To better understand the digital heatlh scenario we have to take a few steps back. More precisely, back to 2020 and to the Covid-19 pandemic. Tech-wise, its only positive aspect is that it spurred and accelerated an impressive adoption of new technologies in very field. And Health sector was, of course, one of the most impacted.

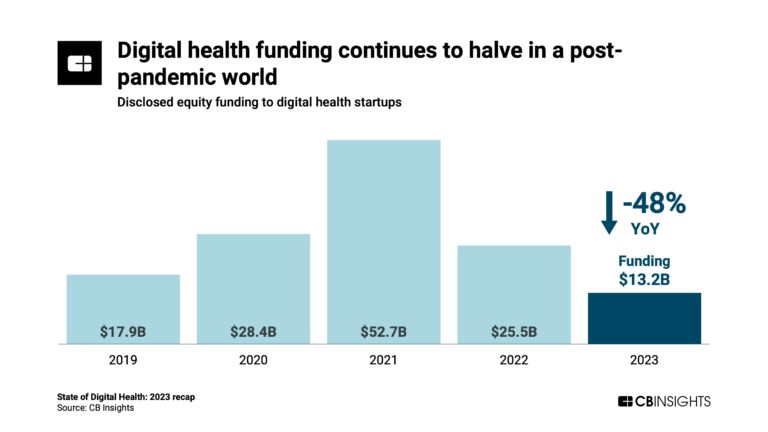

So it wasn't exactly a surprise that digital health funding got to unprecedented levels in 2021. All over the globe. Since then, this funding dropped by 52% year-over-year in 2022 and 48% in 2023 (source: CB Insights). In 2023, digital health funding is estimated at 13.2 billion dollars globally, the lowest level since 2016.

Does this mean that, with the pandemic slowly disappearing in the rearview mirror, the Health sector isn't interested in new tech anymore? Apparently, this is not the case. But health organizations are now more interested in modernizing back-office systems and platforms, an evolution where startups can play a limited role. The biggest slice of this pie is traditionally in the hands of the big IT operators. In EU, this is true more than ever for the Resilience and Recovery funds.

Patients and their families, on the other hand, are more an more digital-focused. They're looking for new wellbeing and self-care apps, telemedicine and telemonitoring services, "serious" health wearables, even AR/VR solutions, and so on. The digital therapies green(ish)field is especially important today: a big percentage of patients - especially chronic ones - consider adopting DTx as a potentially life-changing experience.

It's the market

So, the issue here is not market demand but, it seems, a more punishing global investment landscape. Startups/scaleups must generate a meaningful return in a shorter time, and if they don't seem to be able to do it, investors gradually flee.

The digital healt investment market is therefore shrinking. And, more interestingly, concentrating. Investors spend less and make less deals, but are inclined to invest more in promising companies. In 2023, median equity deal size was at a record high of $4M in 2023, says CB Insights: an 8% increase over 2021. In the same period, generic global venture investments decreased 22%.

Also, the rise in deal size is particularly, and positively, pronounced among Europe-based startups. Good news, in a filed as unbalanced as digital health funding is: nearly 70% of 2023 investments favoured, predictably, US startups. Even if European startups are on the rise, their role on the global scene is still limited.

Francesco Pignatelli

Francesco Pignatelli began his love story with computers and technology at the age of 14, with his ZX81. This led to a career in software development and then in IT and tech journalism. He has spent more than 25 years covering a wide range of IT and tech topics - telecommunications, cyber security, software development, enterprise software, knowledge management - for many of the most important Italian business tech magazines. He is always looking for new digital stuff and still writes unreliable software.

Related news

Last News

RSA at Cybertech Europe 2024

Alaa Abdul Nabi, Vice President, Sales International at RSA presents the innovations the vendor brings to Cybertech as part of a passwordless vision for…

Italian Security Awards 2024: G11 Media honours the best of Italian cybersecurity

G11 Media's SecurityOpenLab magazine rewards excellence in cybersecurity: the best vendors based on user votes

How Austria is making its AI ecosystem grow

Always keeping an European perspective, Austria has developed a thriving AI ecosystem that now can attract talents and companies from other countries

Sparkle and Telsy test Quantum Key Distribution in practice

Successfully completing a Proof of Concept implementation in Athens, the two Italian companies prove that QKD can be easily implemented also in pre-existing…

Most read

Planview Enters 2026 with New Leadership and Continued AI Innovation

Planview®, the leading platform for Strategic Portfolio Management (SPM) and Digital Product Development (DPD), today announced strong 2025 momentum,…

Technology Innovation Institute and World Economic Forum Announce ‘Abu…

The Technology Innovation Institute (TII), the applied research arm of Abu Dhabi’s Advanced Technology Research Council (ATRC), and the World Economic…

Pricefx Enters 2026 With Record Momentum and Breakthrough AI Adoption

#AI--Pricefx, the global leader in AI-powered, cloud-native pricing software, today announced strong 2025 results, marking a year of sustained growth,…

Yelp Announces its 2026 Top 100 Places to Eat in the United States

Yelp, the company that connects people with great local businesses, today announced its 13th annual list of the Top 100 Places to Eat in the U.S., highlighting…