SoFi Technologies, Inc. (NASDAQ: SOFI), a member-centric, one-stop shop for digital financial services that helps members borrow, save, spend, invest and protect their money, reported financial result...

Autore: Business Wire

Adjusted Net Revenue up 33% year-over-year to a record $771 million

Adjusted EBITDA up 46% to a record $210 million

Fee-based Revenue up 67% to a record $315 million

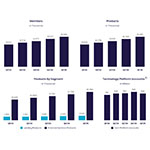

Member growth up 34% to a record 10.9 million members

Product growth up 35% to a record 15.9 million products

Management Raises 2025 Guidance

SAN FRANCISCO: SoFi Technologies, Inc. (NASDAQ: SOFI), a member-centric, one-stop shop for digital financial services that helps members borrow, save, spend, invest and protect their money, reported financial results today for its first quarter ended March 31, 2025.

“We are off to a tremendous start in 2025. In Q1, we delivered durable growth and strong returns driven by our relentless focus on product innovation and brand building,” said Anthony Noto, CEO of SoFi. “We delivered our highest revenue growth rate in five quarters, driven by new records in members, products, and fee-based revenue. These results demonstrate the strength of SoFi's unique strategy, combination of businesses, and product architecture, which give us a sustainable competitive advantage with the highest lifetime value per member. This allows us to innovate unmatched products and services that help members spend less than they make and invest the rest so they can get their money right and realize their ambitions. With strong momentum in the first quarter, we are both accelerating our rate of innovation and increasing our financial guidance for 2025.”

Consolidated Results Summary

|

| Three Months Ended March 31, |

| % Change | |||||||

($ in thousands, except per share amounts) |

|

| 2025 |

|

|

| 2024 |

|

| ||

Consolidated – GAAP |

|

|

|

|

|

| |||||

Total net revenue |

| $ | 771,759 |

| $ | 644,995 |

| 20 | % | ||

Net income |

|

| 71,116 |

|

|

| 88,043 |

|

| (19 | )% |

Net income attributable to common stockholders – diluted |

|

| 71,455 |

|

|

| 22,523 |

|

| 217 | % |

Earnings per share attributable to common stockholders – diluted |

| $ | 0.06 |

|

| $ | 0.02 |

|

| 200 | % |

Consolidated – Non-GAAP(1) |

|

|

|

|

|

| |||||

Adjusted net revenue |

| $ | 770,720 |

|

| $ | 580,648 |

|

| 33 | % |

Adjusted EBITDA |

|

| 210,337 |

|

|

| 144,385 |

|

| 46 | % |

Adjusted net income |

|

| 71,116 |

|

|

| 88,043 |

|

| (19 | )% |

Adjusted net income attributable to common stockholders – diluted |

|

| 71,455 |

|

|

| 22,523 |

|

| 217 | % |

Adjusted earnings per share – diluted |

| $ | 0.06 |

|

| $ | 0.02 |

|

| 200 | % |

(1) |

| For more information and reconciliations of these non-GAAP measures to the most comparable GAAP measures, see “Non-GAAP Financial Measures” and Table 2 to the “Financial Tables” herein. |

Product Highlights

Consolidated Results

SoFi reported a number of key financial achievements. For the first quarter of 2025, GAAP net revenue of $771.8 million increased 20% relative to the prior-year period's $645.0 million. Record adjusted net revenue of $770.7 million grew 33% from the corresponding prior-year period of $580.6 million.

For the first quarter of 2025, total fee-based revenue reached a record of $315.4 million, a year-over-year increase of 67%. This was driven by strong performance from our Loan Platform Business, as well as origination fee revenue, referral fee revenue, interchange fee revenue and brokerage fee revenue. Together, the Financial Services and Technology Platform segments generated $406.5 million of net revenue, an increase of 66% from the prior year period.

SoFi reported its sixth consecutive quarter of GAAP profitability. For the first quarter of 2025, GAAP net income reached $71.1 million and diluted earnings per share reached $0.06.

First quarter record adjusted EBITDA of $210.3 million increased 46% from the prior year period's $144.4 million. This represents an adjusted EBITDA margin of 27%. All three segments delivered strong contribution profit, at attractive margins.

Equity grew by $153.4 million during the quarter, ending at $6.7 billion and $6.05 of book value per share. Tangible book value grew by $167.1 million during the quarter, ending the period at $5.1 billion. Tangible book value per share was $4.58 at quarter-end, up from $3.90 per share in the prior year period.

Net interest income of $498.7 million for the first quarter was up 24% year-over-year. This was driven by a 23% increase in average interest-earning assets and a 82 basis points decrease in cost of funds, partially offset by a 55 basis points decrease in average asset yields year-over-year.

For the first quarter, net interest margin of 6.01% increased 10 basis points sequentially from 5.91%, primarily due to lower cost of funds. The average rate on deposits was 189 basis points lower than that of warehouse facilities, which translates to approximately $515 million of annual interest expense savings.

Member and Product Growth

Continued growth in both total members and products in the first quarter is the result of our continued investments in innovation and brand building and reflects the benefits of our broad product suite and unique Financial Services Productivity Loop (FSPL) strategy.

Added a record 800,000 members in the first quarter of 2025, bringing total members over 10.9 million, up 34% from 8.1 million at the same prior year period.

Record product additions of 1.2 million in the first quarter of 2025, bringing total products to over 15.9 million, up 35% from 11.8 million at the same prior year period.

Financial Services products increased by 36% year-over-year to 13.8 million, primarily driven by continued demand for our SoFi Money, Relay and Invest products, and drove 90% of our total product growth. SoFi Money and SoFi Relay grew to 5.5 million and 5.1 million products, respectively, both representing 41% year-over-year growth. One third of Relay-first members that adopt a second product go on to adopt at least one more product.

Lending products increased by 25% year-over-year to 2.1 million products, driven primarily by continued demand for personal, student and home loan products.

Technology Platform enabled accounts increased by 5% year-over-year to 158 million.

Financial Services Segment Results

For the first quarter of 2025, Financial Services segment net revenue of $303.1 million more than doubled from the prior year period. Net interest income of $173.2 million increased 45% year-over-year, primarily driven by growth in consumer deposits. Noninterest income of $129.9 million more than quadrupled year-over-year, and now represents nearly $520 million in annualized revenue.

In the first quarter, SoFi's Loan Platform Business added $96.1 million to our consolidated adjusted net revenue. Of this $92.8 million was driven by $1.6 billion of personal loans originated on behalf of third parties as well as referrals to third parties. Additionally, our Loan Platform Business generated $3.3 million in servicing cash flow which is recorded in our Lending segment.

In addition to our Loan Platform Business, SoFi continued to see healthy growth in interchange fee revenue in the first quarter, up 90% year-over-year, respectively, as a result of nearly $16 billion in total annualized spend in the quarter across Money and Credit Card.

Contribution profit for the first quarter of 2025 reached $148.3 million, a $111.2 million improvement from the prior year period, while contribution margin grew 24 percentage points year-over-year to 49%. This is a reflection of the strong operating leverage generated in the segment, with directly attributable expenses increasing only 40%.

Financial Services – Segment Results of Operations | |||||||||||

|

| Three Months Ended March 31, |

|

| |||||||

($ in thousands) |

|

| 2025 |

|

|

| 2024 |

|

| % Change | |

Net interest income |

| $ | 173,199 |

|

| $ | 119,713 |

|

| 45 | % |

Noninterest income |

|

| 129,920 |

|

|

| 30,838 |

|

| 321 | % |

Total net revenue – Financial Services |

|

| 303,119 |

|

|

| 150,551 |

|

| 101 | % |

Provision for credit losses |

|

| (5,639 | ) |

|

| (7,165 | ) |

| (21 | )% |

Directly attributable expenses |

|

| (149,148 | ) |

|

| (106,212 | ) |

| 40 | % |

Contribution profit – Financial Services |

| $ | 148,332 |

|

| $ | 37,174 |

|

| 299 | % |

Contribution margin – Financial Services(1) |

|

| 49 | % |

|

| 25 | % |

|

| |

(1) |

| Contribution margin is defined for each of our reportable segments as contribution profit divided by net revenue. |

By continuously innovating with new and relevant offerings, features and rewards for members, SoFi grew total Financial Services products by 3.7 million, or 36%, year-over-year, bringing the total to 13.8 million at quarter-end. SoFi Money reached 5.5 million products, Relay reached 5.1 million products and SoFi Invest reached 2.7 million products by the end of the first quarter.

Monetization continues to improve with annualized revenue per product of $88 during the first quarter, up 48% year-over-year.

In the first quarter of 2025, total deposits grew to $27.3 billion, with over 90% of SoFi Money deposits (inclusive of Checking and Savings and cash management accounts) coming from direct deposit members.

Financial Services – Products |

| March 31, |

|

| |||||

|

| 2025 |

| 2024 |

| % Change | |||

Money(1) |

| 5,477,472 |

| 3,880,021 |

| 41 | % | ||

Invest |

| 2,684,658 |

|

| 2,224,705 |

|

| 21 | % |

Credit Card |

| 306,106 |

|

| 254,617 |

|

| 20 | % |

Referred loans(2) |

| 102,986 |

|

| 59,555 |

|

| 73 | % |

Relay |

| 5,094,484 |

|

| 3,613,686 |

|

| 41 | % |

At Work |

| 119,886 |

|

| 92,389 |

|

| 30 | % |

Total financial services products |

| 13,785,592 |

|

| 10,124,973 |

|

| 36 | % |

(1) |

| Includes checking and savings accounts held at SoFi Bank, and cash management accounts. |

(2) |

| Limited to loans wherein we provide third party fulfillment services as part of our Loan Platform Business. |

Technology Platform Segment Results

Technology Platform segment net revenue of $103.4 million for the first quarter of 2025 increased 10% year-over-year. Contribution profit of $30.9 million reflected contribution margin of 30%.

SoFi continues to diversify its Technology Platform client base beyond financial services companies. During the quarter, SoFi launched a first-of-its-kind co-branded debit card program with Wyndham Hotels & Resorts. The investment made in building this new capability will help the business win additional consumer-brand clients. SoFi also recently signed a deal with Mercantil Banco, which offers personal and business banking services in Panama and will use our Cyberbank Digital banking platform.

Technology Platform – Segment Results of Operations | |||||||||||

|

| Three Months Ended March 31, |

|

| |||||||

($ in thousands) |

|

| 2025 |

|

|

| 2024 |

|

| % Change | |

Net interest income |

| $ | 413 |

|

| $ | 501 |

|

| (18 | )% |

Noninterest income |

|

| 103,014 |

|

|

| 93,865 |

|

| 10 | % |

Total net revenue – Technology Platform |

|

| 103,427 |

|

|

| 94,366 |

|

|||