OptionMetrics Announces IvyDB US – Intraday Daily Snapshots on Equities to Assess Intra-Session Volatility Patterns and 0DTE Option Strategies

#0DTE--OptionMetrics, a historical options database and analytics provider for institutional investors and academic researchers worldwide, announces availability of IvyDB US – Intraday. This new dat...

Hedge funds, institutional investors, academic researchers now have access to gold standard in options data available intraday, to quickly assess risk and trading strategies, alongside increasing speed of markets

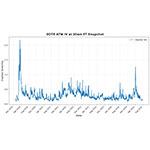

NEW YORK: #0DTE--OptionMetrics, a historical options database and analytics provider for institutional investors and academic researchers worldwide, announces availability of IvyDB US – Intraday. This new dataset capitalizes on the “gold standard” in US options data that OptionMetrics has become known for, while now also including daily snapshots – at 10:00 a.m., 2:00 p.m., and 3:45 p.m. Eastern Time – of options prices and volatility calculations on US exchange-traded equity and index options. IvyDB US – Intraday captures 0DTE (zero days to expiration) options quotes and volatilities with snapshots of underlying prices, zero curves, dividend yields, and borrow rates daily on equities, with historical data beginning in 2018.

IvyDB US – Intraday enables institutional investors to analyze intraday options price movements related to risk events, such as Federal Open Market Committee (FOMC) announcements, earnings, and other corporate news; monitor corporate actions and discrete dividend projections; evaluate models; perform sophisticated research, and backtest strategies.

“The frequency of equity and index trading has increased dramatically. Markets are deeper, more liquid, more responsive to intraday news, and investors are trading across a wider range of securities,” said Eran Steinberg, COO and Chief of Staff at OptionMetrics. “IvyDB US – Intraday capitalizes on the highest quality data that OptionMetrics has become known for, while giving institutional investors additional actionable snapshots to assess 0DTE options and other higher frequency trading strategies throughout the day.”

IvyDB US – Intraday can be used standalone or alongside IvyDB US, OptionMetrics’ flagship database, recognized as the gold standard in historical options data. While IvyDB US – Intraday gives hedge funds, institutional investors, and academic researchers timely, actionable insights on how markets are evolving throughout the day, IvyDB US offers a complete historical record of end-of-day data on US exchange-traded equity and index options starting from January 1996 onward to backtest longer-term strategies. Both datasets leverage the most comprehensive, highest quality data, and monitor corporate actions and discrete dividend projections, ensuring adjustments are fully reflected in option prices.

IvyDB US – Intraday includes:

- Clean, reliable historical data beginning in 2018

- Best bid and ask quotes for each strike and expiration, plus intraday underlying prices

- Volume, implied volatility and greeks for each option and 0DTE

- Introduction of ultra-short tenors on volatility surface (0DTE, 1DTE, 5DTE)

- Industry-standard implied volatility models (binomial trees for American options; discrete dividend projections)

- CUSIP and ticker information

- Unique Security IDs for easy backtesting regardless of CUSIP or ticker changes, or mergers

- FTP (File Transfer Protocol) for automatic updates and flexible customer integration.

Contact info@optionmetrics.com for details.

Fonte: Business Wire

Related news

Last News

RSA at Cybertech Europe 2024

Alaa Abdul Nabi, Vice President, Sales International at RSA presents the innovations the vendor brings to Cybertech as part of a passwordless vision for…

Italian Security Awards 2024: G11 Media honours the best of Italian cybersecurity

G11 Media's SecurityOpenLab magazine rewards excellence in cybersecurity: the best vendors based on user votes

How Austria is making its AI ecosystem grow

Always keeping an European perspective, Austria has developed a thriving AI ecosystem that now can attract talents and companies from other countries

Sparkle and Telsy test Quantum Key Distribution in practice

Successfully completing a Proof of Concept implementation in Athens, the two Italian companies prove that QKD can be easily implemented also in pre-existing…

Most read

Integral AI Unveils World’s First AGI-capable Model

#AGI--Integral AI, a global leader in the development of embodied AGI, today announced the successful testing of the world’s first AGI-capable model.…

Reply Achieves the AWS Agentic AI Specialization and Is Named an Implementation…

Reply [EXM, STAR: REY] announced that it has achieved the Amazon Web Services (AWS) Agentic AI Specialization, a new category within the AWS AI Competency.…

Tecnotree Emerges as CX Catalyst Winner for Impact at The Fast Mode Awards…

Tecnotree, a global digital platform and services leader for AI, 5G, and cloud-native technologies, has won the CX Catalyst award for Impact at The Fast…

CoMotion GLOBAL 2025 Launches in Riyadh: Global Mobility Leaders Unite…

Riyadh is rapidly becoming one of the world's most ambitious urban mobility laboratories, where next-generation technologies move from blueprint to real-world…